As I said last January,

avoiding recession is all that matters for investors. Cash and cash equivalents pay either nothing or next to nothing, while alternative investments yield much more. Cash yields are zero because the demand for money is extremely strong, and because risk aversion is very high. The Fed's QE program has been specifically designed to satisfy this extraordinary demand for money, as I

explained last March. The world eschews much higher-yielding investments in favor of accumulating record levels of cash, because market participants are very afraid of an economic downturn that will reward the decision to hold cash.

Bank savings deposits have soared in the wake of the Great Recession, rising by almost $3 trillion. This is one of the clearest signs of just how risk averse the world is these days.

But holding cash has been a losing proposition because the economy hasn't deteriorated. We haven't seen much in the way of growth, but we certainly haven't seen anything even approaching a recession.

Holding cash has a very high opportunity cost these days, as the above chart demonstrates. So let's review some timely indicators that show how the economy continues to improve, how the risk of a recession remains very low, and why holding cash is a risky proposition.

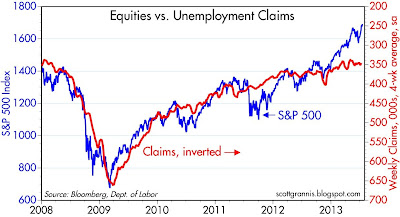

Recessions are invariably preceded by a rise in weekly claims for unemployment. That's not the case today, as claims continue their downward trend.

Announced corporate layoffs remain very low. No sign here of any concerns on the part of corporate business. Corporate profits, meanwhile, are at all-time highs and improving.

The Eurozone has been mired in a recession for the past two years, but lately there are signs that conditions are improving. The Markit survey of Eurozone manufacturing purchasing managers in July registered over 50 for the first time in two years. The U.S. has been doing reasonably well despite the decline in the Eurozone economy; if the Eurozone is indeed now beginning to expand again that should be good news for U.S. exports and U.S. GDP. What's good for Europe is good for the world.

The housing market continues to show signs of a strong recovery. Housing starts remain abysmally low, but they have risen almost 40% in the past two years. It's the change on the margin, not the level, that matters the most to markets and to the economy.

Every recession in the past 50+ years has been preceded by a tightening of monetary policy. What's the best way to measure how tight monetary policy is? The real Fed funds rate, and the slope of the yield curve. Money is tight when real borrowing costs are high, and when the yield curve is flat or inverted. Currently, short-term borrowing costs are negative, and the yield curve is quite steep. This is the market's way of saying that the Fed is very accommodative now, but is expected to raise short-term interest rates in the future as accommodative policy becomes less necessary. Monetary conditions today are the exact opposite of what we usually see leading up to a recession.

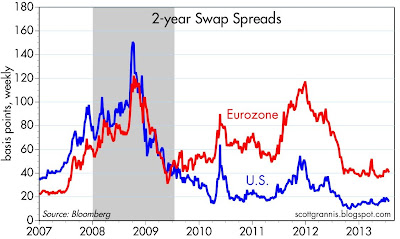

Swap spreads have been very good leading and coincident indicators of systemic risk and the health of the economy. Currently, swap spreads are very low. This means that liquidity is abundant, and the default risk of major financial institutions is very low. It's a lack of liquidity that provokes recessions. Financial markets today are not picking up any signs of deterioration. Indeed, it's just the opposite: from this perspective the economy looks to be in good health and likely to improve rather than deteriorate.

Bloomberg's measure of financial conditions is about as strong as it has ever been, and this reinforces the message of swap spreads. The indicators which comprise this index are sensitive, market-based indicators of financial market health, and are usually very good at anticipating brewing trouble. Today these indicators are pointing up, not down.

The ISM manufacturing index has declined from its 2011 peak, but remains well above levels that in the past have been associated with recessions, as the chart above suggests. Expectations call for the July reading of the index to rise to 52, and that would be consistent with real economic growth of 2-3%, a slight pickup from the 2% growth we've been seeing in the past year or two.

Car sales have been extremely strong for the past four years. When car sales greatly exceed expectations this sends ripple effects all throughout the economy, resulting in stronger production and employment gains—a virtuous cycle.

The private sector has been posting 2% annual growth in employment for more than two years, and there is no sign that this is faltering. The only weak part of the employment picture in this recovery is public sector jobs, but as the second chart above shows, the shrinkage of the public sector workforce looks to be coming to an end. A smaller public sector is a good thing for the economy, since that gives the private sector—the only true source of prosperity—more breathing room.

So: financial markets are very healthy, monetary policy is accommodative, the housing market is getting back on its feet, car sales are booming, Europe is recovering,

business investment is picking up, and jobs are growing. What's not to like?

Answer: cash.