Auto sales have been unusually volatile in the past several months, and they dropped 7% in December. If we exclude them from today's December retail sales release, sales were much stronger than expected (+0.7% vs. +0.4%). If we exclude the other volatile components (building materials and gas stations), sales also beat expectations (+0.7% vs. +0.3%). If, as Brian Wesbury notes, we consider the headwinds that buffeted the economy last year (e.g., the budget sequester, debt limit debate, partial federal shutdown, tapering, and higher long-term interest rates) retail sales by any measure were fairly impressive, increasing about 4% for the year.

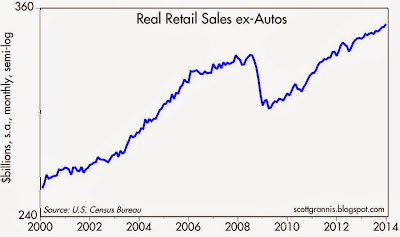

On an inflation adjusted basis, retail sales ex-autos rose about 2.5% last year, with no sign of any emerging weakness or slowdown. (see chart above) Sales are comfortably above their pre-recession highs.

The non-volatile components of retail sales are increasing at almost the same pace that has prevailed for decades. As the chart above shows, the retail sales "control group" increased 4.3% last year, and rose at an annualized pace of 5.5% in the second half of last year.

Despite the huge decline in the labor force participation rate, which has effectively removed some 10 million from the workforce, the economy continues to expand. It could be doing a lot better (e.g., the blue line in the above chart could be tracking the green trend line) if all those people could be enticed back into the labor force and were able to find jobs, but nevertheless the economy continues to expand at a fairly normal pace, which I would argue is somewhat better than the market has been expecting.

Tuesday, January 14, 2014

Subscribe to:

Post Comments (Atom)

5 comments:

Despite this...

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2014/01/20140114_oops.jpg

Watch for Sears and JCP to fall into disorderly bankruptcies later in 2014, followed by waves of mall closures across the US before Christmas 2014 -- the restructuring and consolidation of US retail online is accelerating...

PS: Alternatively, the potential for a Federal bailout of Sears and JCP in 2014 via some innocent looking Goldman Sachs/JPMorgan/BOA type loan or investment is increasingly likely -- a Sears/JCP bankruptcy is more than justified -- but, Fed/Wall Street bank bailout is more likely to occur instead -- the expanding racketeering between the Fed and Wall Street is now fully visible...

Re: disposable income. There is a big problem with disposable income. Disposable income = Income - Taxes paid. That's fine, until you realize that taxes paid can go way up when the market is strong and the economy is healthy. That's because capital gains realizations cause disposable income to fall, even though income is rising, wealth is rising, and the economy is growing. The market has been very strong in recent years and capital gains realizations are up much more than income. So that makes it look like disposable income is down, even as retail sales and nominal GDP are rising.

Recent years are an excellent example of why disposable income is almost a meaningless indicator of economic health.

That is an interesting "pearl" - nothing like in-depth knowledge to provide understanding!

Post a Comment